Over the long term, some collectibles increase in value nicely. Some of them just languish. You can have a lot of fun collecting items that don't increase in value very much, but when it comes time for you to sell, or your family to sell your collection on your behalf after you're gone (Yikes!), it would be nice if your collection was filled with those items that increased in value handsomely.

There are many ingredients in the soup that makes up the future performance of collectibles. One of the strongest ingredients is good demographics. If you collect what the young folks want to collect, you'll probably do fine. But let me tell you about a simplistic way to evaluate them.

LET ME COUNT THE WAYS...

In simple terms, if a collectible has multiple reasons...multiple aspects of attraction...to be a desireable collectible, it will probably do pretty well.

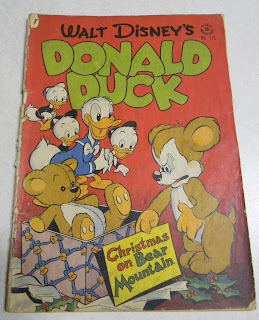

Let me give you an example...look at this comic book:

This is a copy of Four Color Comcs #178. It is the first appearance of Scrooge McDuck. It's worth about $125 in that condition. Why is such a dog-eared book worth so much. Let's count the ways:

1. It's a neat looking cover. Come on! That bear is so cute, and the fact that he's angry makes him even cuter.

2. It's an IMPORTANT book in the series. This is the first appearance of Scrooge McDuck!

3. It's rare. Not a lot of these out there.

4. Interestingly, another reason is that it has "cross-over appeal". It is an item that would be desireable not just to a comic book collector, but also to a Walt Disney Item ("Disneyana") collector.

So we have four reasons why it is desireable. But what if it had all four of those reasons, but it was in high grade? High grade comics are also collected for that aspect alone. Then it would have FIVE reasons why it was desireable. FIVE is more than four, so we'd expect it to be worth more.

Now let's look at another one:

This is Vault of Evil #1. In the condition shown, it's worth $10 to $20. Let's count the reasons why it's a good collectible:

1. It's got a cool cover! Come on man, a WEREWOLF! That's just neat.

2. It's a nicer grade. It's not mint, but it's certainly nicer than the Four Color, right?

3. And....umm....hmmm.... Ok, I'm drawing a blank here. Maybe because it's a first issue??? Though that's not too important in a short, otherwise unimportant series, right?

So in summary, I can really only think of TWO reasons why it would be considered a good collectible. Two is certainly less than Four, so over the long term, this might not do as well as the Four Color, but, in fairness, for it's age, it did OK for the owner's initial 20 cent investment. ***See my blog article about the 1839 Large Cent and the 1939 Nickel where I discuss the ages of collectibles and it's bearing on value***

However, the thing to walk away with is that there are only Two really good reasons to seek it out. There are other comics with more than two reasons that might be a better choice over the long term.

Now let's look at the most valuable comic book out there. A near mint copy of Action #1, which sold recently for $1.5 million. Wow! Crazy money! But let's count the reasons.

1. First Superman Appearance (very important)

2. First Superhero Appearance (extremely important)

3. Very Rare

4. It has a very cool cover (trust me).

5. It is in very high grade

6. There are many other firsts, such as the first super strong character, first character to wear his underwear outside his tights :), first mention of Ma & Pa Kent., etc.

7. It has a track record of steady increases in value. This can be a good reason to buy something, but it can also be a reason that a price bubble is forming...the difference is often based on how fast the price is rising.

OK, so I count several reasons why an Action #1 would be considered desireable. So it's the big winner in our counting contest.

The point here is not to just count the reasons why something is desireable and use that as a valuation tool. It's not a valuation tool. But it is a good screening tool for separating the pearls from the lowly peas. If the collectible you're contemplating purchasing is desireable for only a couple of reasons, you might want to keep shopping. If you find an item where you can think of several reasons why it would be good, like condition, cross-over appeal, rarity, it's "cool factor", then it will probably increase in value nicely over time.

Wednesday, May 2, 2012

Monday, April 30, 2012

"Those Are Hot Right Now."

I was watching one of my favorite shows the other night. I'm a big car buff and I like a show called, Chasing Classic Cars. Maybe you've seen it. The show centers around a fellow named Wayne Carini, who buys, sells, represents and brokers fine automobiles. It's a great show to watch because it combines beautiful cars with collector techniques and mentality. Just as I collect coins, comicbooks, currency, and telescopes, some people collect cars as prolifically. The fact is, I have a car collection too, but it consists of a couple of older air cooled Volkswagens in various states of disrepair. Maybe I should be wrenching on them instead of blogging about them, but then you wouldn't have anything to read, right? :)

ANYWAY...as I was watching the show, Mr. Carini mentioned that he wanted to sell a particular car because "those are hot right now". And that brought me right back to the topic of rotational leadership. (If you hunt for it, I have another blog entry on rotational leadership where I broach this topic.)

But I wanted to reiterate the importance of rotational leadership from a different angle. The "Do" and "Don't" of collecting. Here they are:

Don't chase after something that is "hot right now"....you'll overpay.

Do chase after things that will get hot, hopefully in the near future?

But wait, how do we pick something like that?!!

The answer is:

Chase the things that are hot 95% of the time, but only chase them during that 5% of the time when they are not hot.

OK, I'm exaggerating, but you get the point.

Here's food for thought while you're digesting that. I mentioned my Hulk #2 comicbook in a previous blog.

I watch the price of that book and it varies radically, but it stays in a trading range. Why is that? Well, for starters, there aren't lot of people looking for a low grade Hulk #2. But likewise, there aren't a lot of people putting one up for sale either. Because of this, five buyers of that book earnestly looking to buy it at an online auction site could be considered a high demand so the comic book would be considered "hot". Likewise, five motivated sellers of that book at an online auction site would create a "glut" of them for sale. If there is an oversupply, the sellers will compete with each other on price, and the foolish sellers will lower their prices until others (who may not necessarily want the book) think to themselves, "Wow, I don't need that book but that's too cheap so I'd better buy it".

You want to be that buyer! You want to be the guy or gal who buys it during a glut and then sells it when it's hot. If the item is rare, and appeals to a focused group of buyers, the price differential between a glut and a hot market can be a large swing. So buy during a glut and sell when they are hot. That's what the professionals do.

ANYWAY...as I was watching the show, Mr. Carini mentioned that he wanted to sell a particular car because "those are hot right now". And that brought me right back to the topic of rotational leadership. (If you hunt for it, I have another blog entry on rotational leadership where I broach this topic.)

But I wanted to reiterate the importance of rotational leadership from a different angle. The "Do" and "Don't" of collecting. Here they are:

Don't chase after something that is "hot right now"....you'll overpay.

Do chase after things that will get hot, hopefully in the near future?

But wait, how do we pick something like that?!!

The answer is:

Chase the things that are hot 95% of the time, but only chase them during that 5% of the time when they are not hot.

OK, I'm exaggerating, but you get the point.

Here's food for thought while you're digesting that. I mentioned my Hulk #2 comicbook in a previous blog.

I watch the price of that book and it varies radically, but it stays in a trading range. Why is that? Well, for starters, there aren't lot of people looking for a low grade Hulk #2. But likewise, there aren't a lot of people putting one up for sale either. Because of this, five buyers of that book earnestly looking to buy it at an online auction site could be considered a high demand so the comic book would be considered "hot". Likewise, five motivated sellers of that book at an online auction site would create a "glut" of them for sale. If there is an oversupply, the sellers will compete with each other on price, and the foolish sellers will lower their prices until others (who may not necessarily want the book) think to themselves, "Wow, I don't need that book but that's too cheap so I'd better buy it".

You want to be that buyer! You want to be the guy or gal who buys it during a glut and then sells it when it's hot. If the item is rare, and appeals to a focused group of buyers, the price differential between a glut and a hot market can be a large swing. So buy during a glut and sell when they are hot. That's what the professionals do.

How To Get Collectibles For Free

It isn't rocket science. I think we all know that you'll get a better price for your collectibles if you sell them individually. If your collectibles consist of five rare coins, three rare pieces of currency and a couple of rare comicbooks, do you think you'd get more money for them if you sold them as a group? Of course not. Because the comicbook collector who may want one of your comics would be forced to buy coins and currency. She might not know anything about them, right? And if she didn't, she'd bid on them conservatively...that's just human nature.

OK, what about 3 dissimilar revolvers from the 1800's? The guy who really knows his Colt Revolvers may not have much knowledge on the value of an off-brand, so he'll bid conservatively. Perhaps he'd bid against another fellow who doesn't have the money for the off-brand revolvers so he doesn't place a large bid, even though he could have paid top dollar for that off-brand.

See the point? Selling items in individual lots is almost always bad for the seller. The only time it is good for the seller is if the items are very similar and cheap so that the savings in shipping costs can outweigh the seller's disgust of having to buy items they don't want.

But this article is about getting stuff for free!

We've established that selling things in a lot, group, or collection is generally bad, right? But let us remember, what is bad for the seller is probably good for the buyer!

As a buyer, we should be looking for lots.

I bought a lot of two coins and two Hawaii Emergency $5 notes. I sold just one of the $5 notes for almost as much I paid for the entire lot. I haven't gotten around to selling the coins yet, but they should easily sell for more that I have left in the lot. So I get to keep the best $5 note for free.

I recently bought a large group of Mexican Currency from a dealer friend. I got a pretty good price. Good enough to place some of the items up for sale to get my money back, and I will get to keep a few pieces for myself.

As I write this, I'm waiting on an auction lot I won to arrive by mail. It's also foreign currency. When I get it, I can sell off a couple of the pieces from that lot and have the rest free and clear.

See? Free stuff. It can be labor intensive, but if cash is tight you can "earn" free stuff by playing the middle man and selling the lot/collection as it should have been sold....individually.

OK, what about 3 dissimilar revolvers from the 1800's? The guy who really knows his Colt Revolvers may not have much knowledge on the value of an off-brand, so he'll bid conservatively. Perhaps he'd bid against another fellow who doesn't have the money for the off-brand revolvers so he doesn't place a large bid, even though he could have paid top dollar for that off-brand.

See the point? Selling items in individual lots is almost always bad for the seller. The only time it is good for the seller is if the items are very similar and cheap so that the savings in shipping costs can outweigh the seller's disgust of having to buy items they don't want.

But this article is about getting stuff for free!

We've established that selling things in a lot, group, or collection is generally bad, right? But let us remember, what is bad for the seller is probably good for the buyer!

As a buyer, we should be looking for lots.

I bought a lot of two coins and two Hawaii Emergency $5 notes. I sold just one of the $5 notes for almost as much I paid for the entire lot. I haven't gotten around to selling the coins yet, but they should easily sell for more that I have left in the lot. So I get to keep the best $5 note for free.

I recently bought a large group of Mexican Currency from a dealer friend. I got a pretty good price. Good enough to place some of the items up for sale to get my money back, and I will get to keep a few pieces for myself.

As I write this, I'm waiting on an auction lot I won to arrive by mail. It's also foreign currency. When I get it, I can sell off a couple of the pieces from that lot and have the rest free and clear.

See? Free stuff. It can be labor intensive, but if cash is tight you can "earn" free stuff by playing the middle man and selling the lot/collection as it should have been sold....individually.

A Common Theme Among Collectors

It's been a while since I blogged, so I thought I'd share a thought with you. Over the last few weekends, I tried my hand as a comic book dealer. I set up at some shows with the idea of both selling, and buying. I set my prices to sell my "lesser" material at bargain prices and I wanted top dollar for my nice material.

Fact is, I knew exactly what I wanted to sell my better comicbooks for. How did I price them? I have a low grade copy of Hulk #2 in a CGC Slab. My copy grades a 3.0.

I set my sell price at the dollar figure that would allow me to take the cash and then go to a popular on-line auction site and buy the same book in the grade 3.5. While this may give the impression that my book was over-priced, it was not. I shopped hard for that 3.5, and all I needed was a buyer who wanted my book and wasn't aware of a slighlty nicer copy. Alas, it did not happen. In fact, I sold very few expensive comics while I was acting as a dealer. Disappointing, really. I do not attribute it to my prices, but rather to the economy in general. People seemed to sit on their wallets at the shows I was selling at.

Always one to make lemonade out of lemons, I decided to make money other ways. I did sell a lot of Manga books and a few hats and some of the cheaper books. They paid for the adventure. But another way I wanted to make money was on the purchase of comicbooks. I looked at the shows as a buying opportunity.

OK, we're drilling down to the point of this long-winded diatribe. I met not just one, but several collectors who were interested in my better priced books, but did not buy. Seeing that they weren't interested in purchasing, after establishing they had good books at home, I told them that I was a buyer.

and here's the thing...

Of the guys who truly gave the impression of having good stuff, they all had one thing in common:

THEY ALL REFUSED TO SELL ANYTHING.

Yep, there's the theme of this blog entry. All of them refused to sell their good material. And that makes sense. Why is it that savers always have money and spenders never do? Because the spenders give their money to someone else, but the savers do not. The same is true of collectors. If you want to have a big collection, worth oodles and oodles of cash, you must learn one important rule.

IF YOU GET SOMETHING REALLY GOOD, DON'T SELL IT.

The best way to get a great return on a collection is to fill that collection with good things and keep them. If you sell your best stuff, you end up with a collection of run-of-the-mill stuff, or no collection at all.

So, if you collect, and you get something great, don't sell it. If you absolutely need cash, try to sell off the more common stuff first. That can take discipline and timing because the fastest way to raise cash is to sell the better stuff. But try not to do that, OK?

Fact is, I knew exactly what I wanted to sell my better comicbooks for. How did I price them? I have a low grade copy of Hulk #2 in a CGC Slab. My copy grades a 3.0.

I set my sell price at the dollar figure that would allow me to take the cash and then go to a popular on-line auction site and buy the same book in the grade 3.5. While this may give the impression that my book was over-priced, it was not. I shopped hard for that 3.5, and all I needed was a buyer who wanted my book and wasn't aware of a slighlty nicer copy. Alas, it did not happen. In fact, I sold very few expensive comics while I was acting as a dealer. Disappointing, really. I do not attribute it to my prices, but rather to the economy in general. People seemed to sit on their wallets at the shows I was selling at.

Always one to make lemonade out of lemons, I decided to make money other ways. I did sell a lot of Manga books and a few hats and some of the cheaper books. They paid for the adventure. But another way I wanted to make money was on the purchase of comicbooks. I looked at the shows as a buying opportunity.

OK, we're drilling down to the point of this long-winded diatribe. I met not just one, but several collectors who were interested in my better priced books, but did not buy. Seeing that they weren't interested in purchasing, after establishing they had good books at home, I told them that I was a buyer.

and here's the thing...

Of the guys who truly gave the impression of having good stuff, they all had one thing in common:

THEY ALL REFUSED TO SELL ANYTHING.

Yep, there's the theme of this blog entry. All of them refused to sell their good material. And that makes sense. Why is it that savers always have money and spenders never do? Because the spenders give their money to someone else, but the savers do not. The same is true of collectors. If you want to have a big collection, worth oodles and oodles of cash, you must learn one important rule.

IF YOU GET SOMETHING REALLY GOOD, DON'T SELL IT.

The best way to get a great return on a collection is to fill that collection with good things and keep them. If you sell your best stuff, you end up with a collection of run-of-the-mill stuff, or no collection at all.

So, if you collect, and you get something great, don't sell it. If you absolutely need cash, try to sell off the more common stuff first. That can take discipline and timing because the fastest way to raise cash is to sell the better stuff. But try not to do that, OK?

Sunday, April 1, 2012

Local Auctions Don't Have to be Inconvenient

I've considered bidding on collectible auctions in the past, but I found it "infeasible" because I don't have the time to attend. Boy, was I wrong! You don't have to attend to win!

This weekend I went to a local auction site to look at currency. They often hold back some for direct sales. I learned that they were having an auction the next day, Sunday. I lamented outloud that I couldn't go, and they told me that I could put in a proxy bid. It was easy. Fill out a form, mark down the lot you want to bid on, and then cross your fingers. The nice thing about this method is that you can look at the item closely. And in my case, I even used my smartphone to look up some of the items on ebay to find out what they were selling for. I was convenient to have the time to do that.

So what happened? I put in a $135 proxy bid on a CU64 Hawaii $1 note, certified by PMG with an "exceptional paper quality (EPQ)" designation. I also put in a $110 bid on a 1917 $2 note in VF+ condition. Conclusion? I won them both. My winning bids were $100 plus an $18 buyers fee on the Hawaiian note, and $90 plus a $17 buyers fee. Total cost...about $225 combined. Value of these notes on Ebay is about $180 for the Hawaii and $150 for the $2 note. That's a gain of $105 on some nice notes. I intend to keep them, so it boosts my progress in my on-going flipping contest. After my comicbook sales last week, I was at $213. So now I can add 1/3 of $105, or $35, so I'm now at $248. (The reader may not be aware, but when I decide to keep an item, I can only declare 1/3 of the "profit" per the contest rules. I might be selling some more comicbooks which I recently stole (ahem...I mean purchased) from a local dealer if I can find the time.

The bottom line is this though....local auction proxy bids can be very good, and you can inspect the merchandise too. Just remember that you need to factor in a buyer's premium...in my case, a hefty 18%

Collector Steve

This weekend I went to a local auction site to look at currency. They often hold back some for direct sales. I learned that they were having an auction the next day, Sunday. I lamented outloud that I couldn't go, and they told me that I could put in a proxy bid. It was easy. Fill out a form, mark down the lot you want to bid on, and then cross your fingers. The nice thing about this method is that you can look at the item closely. And in my case, I even used my smartphone to look up some of the items on ebay to find out what they were selling for. I was convenient to have the time to do that.

So what happened? I put in a $135 proxy bid on a CU64 Hawaii $1 note, certified by PMG with an "exceptional paper quality (EPQ)" designation. I also put in a $110 bid on a 1917 $2 note in VF+ condition. Conclusion? I won them both. My winning bids were $100 plus an $18 buyers fee on the Hawaiian note, and $90 plus a $17 buyers fee. Total cost...about $225 combined. Value of these notes on Ebay is about $180 for the Hawaii and $150 for the $2 note. That's a gain of $105 on some nice notes. I intend to keep them, so it boosts my progress in my on-going flipping contest. After my comicbook sales last week, I was at $213. So now I can add 1/3 of $105, or $35, so I'm now at $248. (The reader may not be aware, but when I decide to keep an item, I can only declare 1/3 of the "profit" per the contest rules. I might be selling some more comicbooks which I recently stole (ahem...I mean purchased) from a local dealer if I can find the time.

The bottom line is this though....local auction proxy bids can be very good, and you can inspect the merchandise too. Just remember that you need to factor in a buyer's premium...in my case, a hefty 18%

Collector Steve

Sunday, February 19, 2012

Observations from a big comicbook show

I just got back from the 2012 Megacon comicbook convention. I have to say, comicbooks were selling briskly! Dealers were complaining that much of their good material sold quickly. By the time I got there on Saturday, the second day of the show, I felt lucky that I found anything good for full guide prices. Seemed like all of the good material still lingering on the dealers display were overpriced. And for the priviledge of paying guide for nice items, I had to really search!

Interestingly, I've been hearing anecdotal feedback about coins and currency sales as well. Things are picking up a bit. Perhaps this is a sign that the economy is improving, or just new confidence in collectibles in general. Whatever the case, good material costs more than guide. If you can find it for guide, you may be doing better than you think if you buy it.

Steve

Sunday, February 5, 2012

A Secret Between Us

Let me guess...you saw the title of this thread and your curiousity got the better of you. You had to open it up and find out what it said, right? If so, congrats. I think your curiousity is going to pay off for you. Read this all the way through and you'll see why.

Way back in the year 2009 (remember then?) we were in a deepest part of the great recession and people needed money. At the same time, the company that produces coinstar machines was growing by leaps and bounds. Coinstar machines make it so convenient to cash in your change...just pour it into a machine and they deduct a fee for "folding money". This set up the perfect storm for recirculation of old coinage. So many people on hard times brought in their old coins to cash them in that the banks were awash with coinage. So the banks didn't order much new coinage, and mintages were abnormally low.

Now lets talk about one of my favorite coins, the Jefferson Nickel. I love them as a collectible coin. I've always thought they are under-rated as a coin. They have overdates, repunched mintmarks, silver varieties, and unique toning that makes them very fun to collect. Plus, unlike many coin series, they are inexpensive enough to collect by date and mintmark, which speaks volumes about the future potential of the series.

By now, you've probably figured out that this article is about the 2009 nickel. Yes it is! But here's the interesting part. The 2009 Philadelphia ("P") mint nickel was the first to be found in pocket change in the middle of 2009. 39.8 million of these nickels were minted, making them the lowest mintage for a few decades. Because of that, these nickels were well received in the aftermarket. I watched prices of these nickels climb to about $80 a roll before they showed up in large numbers. Then this glut of nickels, and competition to sell them drove the roll prices down to about the $18 level (that I witnessed) before supplies started to dry up. Prices then began to climb and they are now at about $60 per roll (early 2012 prices).

Here's the cool part. The Denver mint 2009 ("D") nickels seem to be following in the footsteps of the "P" mint nickels. They have a slightly higher mintage of 46.8 million. But interestingly, they weren't even released until a few months into 2010! I did see a roll of these nickels that may, or may not have been a genuine ebay listing that surfaced in 2009 that sold for almost $200 a roll. That doesn't matter. My point is that these nickels were released almost a year later than their "P" mint cousins. What happened then? Well, I watched their per roll price fall from $60 per roll downward to a low of $8 each. Yours truly, bought a few of them at $8 on speculation a few months ago. Since that time, the price has steadily risen to about $15 per roll individually and it sure does seem like the prices are drying up. I managed to buy some more on a bulk purchase that will cost me about $11 per roll delivered.

To recap, the "P" mint started at $80 per roll, suffered through a glut of sales on ebay that drove the price down to about $18 a roll before rebounding to about $60 per roll. The "D" mint rolls were released a year later, and in part because they are almost as rare, appear to be following the same path. Like every collectible that I mention in this blog, you need to make up your own mind on purchasing these, but it wouldn't surprise me to see these selling for $50 a roll within a year or so.

If you buy some 2009-D Nickels, you need to make sure that you are buying uncirculated "BU" rolls. Original bank rolls. Focus on getting them as cheap as you can per roll after factoring in your shipping costs. Once you get them, don't open the rolls. Some of their value is tied to the fact that they are unsearched.

Now remember, this is our secret...your reward for reading this blog. Here's a link that sorts lowest prices first on ebay for your research: http://www.ebay.com/sch/i.html?_nkw=2009%20d%20nickel%20roll%20-p&_dmpt=Coins_US_Individual&_fln=1&_sc=1&_sop=15&_ssov=1&_trksid=p3286.c0.m1539&_mPrRngCbx=1&_udlo=4&_udhi=

Collector Steve

***Update: When I wrote that article, I finished buying some rolls at $11 each. Some I got as cheap as $8. It appears they are now around $16 each for the best deal. That's a 50% to 100% return so far in about 6 months or so. You can make a killing in collectibles if you apply the right concepts.

Way back in the year 2009 (remember then?) we were in a deepest part of the great recession and people needed money. At the same time, the company that produces coinstar machines was growing by leaps and bounds. Coinstar machines make it so convenient to cash in your change...just pour it into a machine and they deduct a fee for "folding money". This set up the perfect storm for recirculation of old coinage. So many people on hard times brought in their old coins to cash them in that the banks were awash with coinage. So the banks didn't order much new coinage, and mintages were abnormally low.

Now lets talk about one of my favorite coins, the Jefferson Nickel. I love them as a collectible coin. I've always thought they are under-rated as a coin. They have overdates, repunched mintmarks, silver varieties, and unique toning that makes them very fun to collect. Plus, unlike many coin series, they are inexpensive enough to collect by date and mintmark, which speaks volumes about the future potential of the series.

By now, you've probably figured out that this article is about the 2009 nickel. Yes it is! But here's the interesting part. The 2009 Philadelphia ("P") mint nickel was the first to be found in pocket change in the middle of 2009. 39.8 million of these nickels were minted, making them the lowest mintage for a few decades. Because of that, these nickels were well received in the aftermarket. I watched prices of these nickels climb to about $80 a roll before they showed up in large numbers. Then this glut of nickels, and competition to sell them drove the roll prices down to about the $18 level (that I witnessed) before supplies started to dry up. Prices then began to climb and they are now at about $60 per roll (early 2012 prices).

Here's the cool part. The Denver mint 2009 ("D") nickels seem to be following in the footsteps of the "P" mint nickels. They have a slightly higher mintage of 46.8 million. But interestingly, they weren't even released until a few months into 2010! I did see a roll of these nickels that may, or may not have been a genuine ebay listing that surfaced in 2009 that sold for almost $200 a roll. That doesn't matter. My point is that these nickels were released almost a year later than their "P" mint cousins. What happened then? Well, I watched their per roll price fall from $60 per roll downward to a low of $8 each. Yours truly, bought a few of them at $8 on speculation a few months ago. Since that time, the price has steadily risen to about $15 per roll individually and it sure does seem like the prices are drying up. I managed to buy some more on a bulk purchase that will cost me about $11 per roll delivered.

To recap, the "P" mint started at $80 per roll, suffered through a glut of sales on ebay that drove the price down to about $18 a roll before rebounding to about $60 per roll. The "D" mint rolls were released a year later, and in part because they are almost as rare, appear to be following the same path. Like every collectible that I mention in this blog, you need to make up your own mind on purchasing these, but it wouldn't surprise me to see these selling for $50 a roll within a year or so.

If you buy some 2009-D Nickels, you need to make sure that you are buying uncirculated "BU" rolls. Original bank rolls. Focus on getting them as cheap as you can per roll after factoring in your shipping costs. Once you get them, don't open the rolls. Some of their value is tied to the fact that they are unsearched.

Now remember, this is our secret...your reward for reading this blog. Here's a link that sorts lowest prices first on ebay for your research: http://www.ebay.com/sch/i.html?_nkw=2009%20d%20nickel%20roll%20-p&_dmpt=Coins_US_Individual&_fln=1&_sc=1&_sop=15&_ssov=1&_trksid=p3286.c0.m1539&_mPrRngCbx=1&_udlo=4&_udhi=

Collector Steve

***Update: When I wrote that article, I finished buying some rolls at $11 each. Some I got as cheap as $8. It appears they are now around $16 each for the best deal. That's a 50% to 100% return so far in about 6 months or so. You can make a killing in collectibles if you apply the right concepts.

Subscribe to:

Posts (Atom)